PeopleSol Payroll

Payroll is a critical function that ensures timely and accurate salary payments to employees.The PeopleSol payroll module automates the process, eliminates errors, reduces manual effort, and increases compliance. It also enables easy access to payment and tax-related data and offers multiple payment options to employers.

Challenges Companies Face in Payroll Process?

Compliance

issue

Keeping up with local, state, and central regulations can be complex and time-consuming.

Less

accuracy

Ensuring all payroll calculations are accurate, including taxes, benefits, and overtime pay.

Stiff

timeliness

Making sure that payroll is processed on time and employees are paid accurately and on time.

Cross

integration

Coordinating with other systems and departments, such as tax, benefits, and time and attendance, to ensure all data is accurate and up to date.

Information

security

Keeping sensitive employee data and financial information secure and protected.

Record

keeping

Maintaining accurate and complete payroll records to ensure compliance and easy access to information.

PeopleSol Payroll Features?

Statutory

Compliance

The ability to post job openings on various job boards and company websites.

Pay

Components

The ability to extract relevant information from candidate resumes and store it in a centralized database.

Pay

Templates

The ability to track and manage the entire recruitment process, including the status of each candidate, interview schedules, and feedback.

Pay

Schedule

The ability to search and filter candidates based on specific criteria such as experience, education, and skills.

Salary

Templates

The ability to manage and track communication with candidates, such as email and SMS, in one central location.

Salary

Slips

The ability to generate reports and analyze recruitment data to gain insights into the effectiveness of the recruitment process.

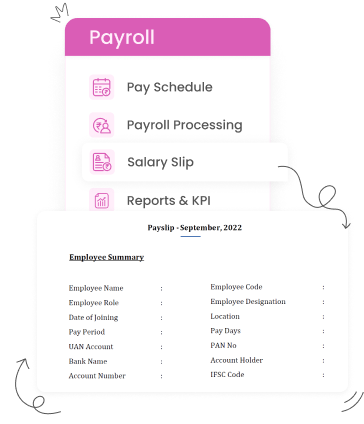

PeopleSol

Payroll

Automate payroll processes to free up HR staff for more important tasks. Payroll data provides insights into labor costs, helping employers better plan and manage finances. Payroll systems help avoid costly errors and potential penalties for non-compliance with payroll laws. Accurate and timely pay, benefits administration, and compliance with laws can improve employee satisfaction and retention.

Accurate and

Timely Pay

By using the PeopleSol payroll system, employers can ensure that their employees are paid accurately and on time, which can help improve employee satisfaction and retention

Compliance with

Laws and Regulations

PeopleSol Payroll helps employers stay compliant with payroll laws and regulations, including tax and labor laws.

Improved

Efficiency

Automated payroll processes save time and reduce errors, freeing up HR and payroll staff to focus on other important tasks.

Better Financial

Planning

Payroll data provide valuable insights into labor costs, which can help employers better plan and manage their finances.

Enhanced

Security

Payroll systems help protect sensitive employee data, such as social security numbers and banking information, from unauthorized access.

Benefits

Administration

Some payroll systems also include benefits administration features, which can help employers manage employee benefits such as health insurance and retirement plans.