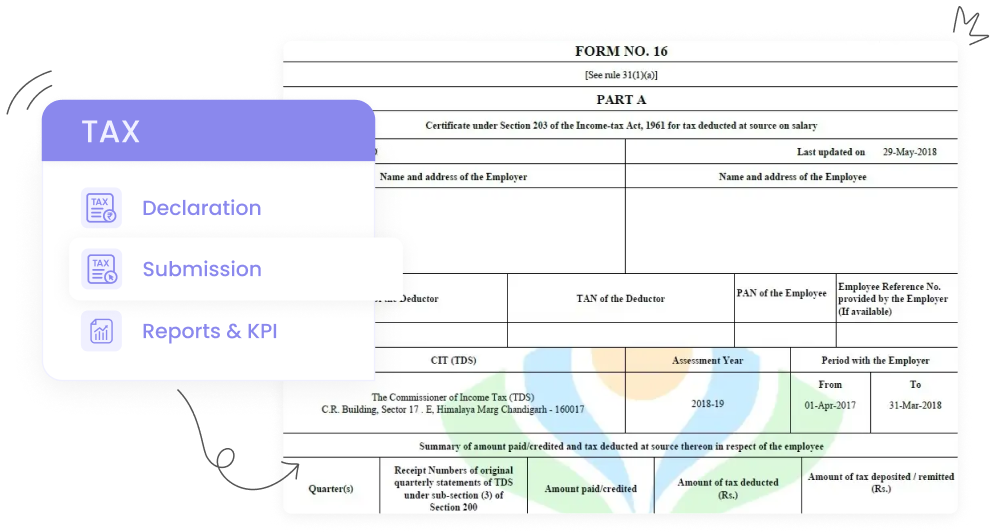

PeopleSol Tax

HRMS tax declaration and submission allow organizations and employees to file their tax returns online. It provides a secure platform for taxpayers to declare their tax savings and submit proof to the employer. PeopleSol offers a user-friendly interface, helpful prompts, and error-detection tools to ensure accurate and efficient tax filing.

Challenges Companies Face in Tax Process

Manual hiring, which involves performing all recruitment tasks without the use of an applicant tracking system (ATS), can be a time-consuming and inefficient process that can lead to several challenges for companies. Manual hiring can lead to an inefficient, inconsistent, and ineffective recruitment process that can negatively impact a company's ability to attract and hire the best candidates for the job, including:

Time-consuming

data entry

Manually entering employee data and tax information can be time-consuming and prone to errors, increasing the risk of mistakes on tax forms.

Difficulty tracking

deadlines

Companies may struggle to keep track of tax filing and payment deadlines, leading to missed deadlines and penalties.

Incomplete or inaccurate

information

Employees may provide incomplete or inaccurate tax information, leading to errors on tax forms and potential penalties.

Tedious paper-based

processes

Manually managing tax declaration and submission processes can involve extensive paperwork, which can be tedious and time-consuming.

Difficulty accessing and

updating records

Companies may struggle to access and update tax records, making it difficult to track compliance with tax laws and regulations.

Lack of visibility

into tax status

Companies may have limited visibility into the tax status of employees, making it difficult to track compliance and identify potential issues.

PeopleSol Tax Features

Integration

with payroll

PeopleSol Tax seamlessly integrates with payroll systems to automatically import employee salary and tax information, reducing data entry errors.

Employee

self-service

PeopleSol Tax allows employees to access and fill out their own tax forms, reducing the administrative burden on HR departments.

Compliance

monitoring

Monitor compliance with tax laws and regulations, alerting HR departments to potential issues.

Automated tax

calculations

Automatically calculate tax deductions based on employee salary and tax information, reducing errors.

Online

submission

Online submission of tax forms, reducing paperwork and streamlining the process.

Record

keeping

Store tax data and records, making it easy for HR departments to access and retrieve information as needed.

PeopleSol

Tax

Automated HRMS tax submission and declaration process can lead to cost savings by reducing administrative costs, minimizing errors, and avoiding costly penalties for non-compliance.

Improved

accuracy

Automated HRMS tax submission and declaration process reduces the risk of errors and mistakes that can occur in manual data entry, leading to more accurate tax calculations.

Reduced administrative

burden

Automated HRMS tax submission and declaration process streamlines the process, reducing the administrative burden on HR departments and freeing up time for other tasks.

Improved

compliance

Automated HRMS tax submission and declaration process reduces the risk of non-compliance with tax laws and regulations, which can lead to costly penalties and legal issues.

Enhanced data

security

The automated HRMS tax submission and declaration process ensures that sensitive employee data is stored securely and transmitted safely, reducing the risk of data breaches.

Faster tax

processing

Automated HRMS tax submission and declaration process can speed up the tax processing and refund process, reducing the time employees have to wait for their refunds.

Real-time

status updates

The automated HRMS tax submission and declaration process provides real-time status updates on tax submissions and payments, reducing uncertainty and anxiety for both employees and HR departments.